What is homeownership?

Homeownership is when someone owns a home.

Homeownership is also the most important determinant of wealth. According to the U.S. Census Bureau, people who own homes have a median net worth that is 80 times the net worth of people who rent. In a country like America, where real estate is considered capital, owning a home is more important than having a bank account, a job or even an education.

It’s a white thing.

OK, here we go. Let me guess: White people own homes and people of color don’t own homes. Don’t you own a home? Why is it always racial with you!

My bad. I was referring to the racial homeownership gap.

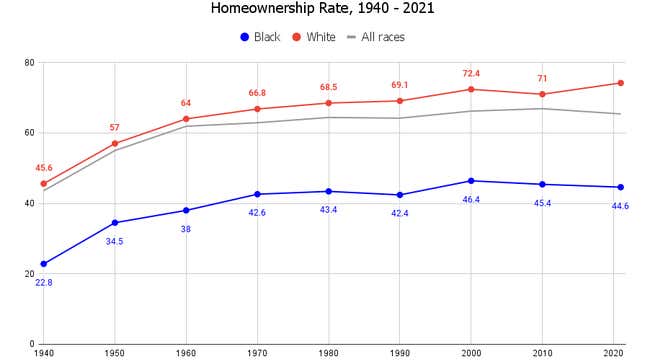

According to the U.S. Census Bureau, the Black homeownership rate in America was 44.6 percent for the second quarter of 2021. Meanwhile, the white homeownership rate was 74.2 percent.

So when I say “white people,” I’m not overgeneralizing; I’m referring to the statistical fact that three out of every four white people have access to the largest tool for wealth-building and the majority of Black people do not. It’s how numbers work.

But you’re right. It’s not a problem faced by “people of color.” That same data shows that the homeownership rate for “all other races” is 56.2 percent. Nearly 60 percent of Asian Americans, Native Americans, Hawaiians and Pacific Islanders own a home. Forbes notes that Latino homeownership is rising “at a much faster pace than white or Black Americans, with 50.1% of Hispanic or Latino Americans owning their home in 2020, up from 45.4% in 2014.”

“Not one of the 100 cities with the largest Black populations has a Black homeownership rate close to the white homeownership rate,” reports the Urban Institute. “Even in places where Black households are the majority.”

Next, you’re gonna explain how this is due to racism from the past and how the gap isn’t closing fast enough, right?

I’d never do that...

Mostly because the Black-to-white homeownership gap isn’t closing at all. In fact, according to the National Community Reinvestment Coalition and the Census Bureau, the current 30-point difference between Black and white homeownership is larger than it was in the 1950s and 1960s—when it was legal for financial institutions to discriminate on the basis of race.

African Americans are the only racial or ethnic group in America that has never achieved a 50 percent homeownership rate.

But most of that racism stuff was in the past. Houses cost money and money doesn’t grow on trees.

You’re right. But imagine if money did grow on trees!

Imagine if someone discovered a species of trees that blossomed with $100 bills. Do you think there would still be a wealth disparity in America?

Of course not, because everyone would have access to money!

But what if some people didn’t have money trees? The money tree owners would be rich and everyone else would be poor, right?

Sure they would! But some people could eventually find seeds and plant their own money trees.

Why do you believe that? It would be in the best interest of money tree owners to limit the supply of money trees. If money trees did exist, the smart move would be to steal the land where money trees grew and bring in stolen labor to help you grow money trees. But of course, you’d have to use violence or the threat of violence to make sure they didn’t take their money-tree growing knowledge and grow their own money trees.

And, even if they eventually freed from the money tree plantation and planted their own seeds, you could just make it illegal for them to live in a neighborhood where money trees can grow. Or, you could just steal their money tree. If push came to shove, you could burn down entire groves of money trees. Even if the former money tree slaves survived with a few seeds, it takes money trees a long time to grow, so the money tree owners would have so much of an advantage that their children would have money tree privilege.

Wait, is this an analogy or something? You still haven’t explained the racial housing gap. Maybe if you worked hard and focused on education, you’d own homes. But I bet you’re gonna blame the white man, when it’s really an economic issue.

No one is arguing that Black people can’t grow their own money trees. But white people have had a 400-year head start in the money tree farming business.

We did a whole video on the legacy of redlining because it explains why there are so few money trees in Black neighborhoods. We’ve written about banks discriminating against Black homebuyers because it shows how, in a capitalist system built on land ownership, controlling the money-tree seed market is as valuable as owning money trees. Some Black people don’t even qualify to get their own seeds, which is why we explained how credit scoring disproportionately impacts Black borrowers. And how can Black people learn how to grow their own seeds if education disparities exist?

But white people still insist on framing these disparities as “economic issues” because they “don’t see color.”

The current dispute over two Democratic proposals to address the racial homeownership gap is a great example of this phenomenon.

What are the two proposals?

The first plan is the Decent Affordable Safe Housing (DASH) For All Act introduced by Sen. Ron Wyden (D-Ore.). Wyden’s plan would create a refundable $15,000 tax credit for first-time homebuyers to use toward the down payment on a home. The other bill comes from Sen. Raphael Warnock (D-Ga.) His Downpayment Toward Equity Act of 2021, would create a new program that offers up to $25,000 to first-generation homebuyers.

Both sound like good plans, but Wyden’s DASH Act would actually increase housing inequality, while Warnock’s plan would help reduce racial housing disparities.

Is it because Warnock’s plan offers more money?

Nope. It’s because Wyden’s plan is one of those “race-neutral” ideas we talked about earlier, while Warnock’s bill actually addresses racial housing disparities, as Politico reports:

One of the thorniest parts of the debate is whether all first-time homebuyers should be eligible for government aid or if it should be further targeted at first-generation buyers, whose parents do not own a home.

Wyden’s proposed $15,000 tax credit for first-time homebuyers aligns with an important plank of the housing plan that Biden touted on the campaign trail. But Wyden is facing opposition from affordable housing advocates who say it could push up home prices and fail to benefit people who truly can’t afford a down payment. They say relying on a tax credit would also be less effective than offering direct payments to homebuyers, as proposed by Waters and Warnock.

“Those who really need the help will have a hard time buying a home without having that help at the time of closing, but the IRS is ill-suited to work with lenders and borrowers quickly enough to make that happen through a tax credit,” said Jim Parrott, former economic adviser to the Obama White House. “So this tax credit is likely to help only those who already could have put down the needed down payment buy a more expensive house, not expand access to homeownership.”

OK, I just read the summary for both plans and they both focus on potential new homeowners. Neither says anything about race. So why is one better than the other?

Notice that the DASH Act’s summary specifically mentions “first-time homebuyers.” The Downpayment Toward Equity Act of 2021, is geared toward first-generation homebuyers.

There is a subtle difference between the two.

A “first-time homeowner” could be the child of a rich parent who is purchasing their first property. But a first-generation homeowner, as described in the bill, is someone whose “living parents or guardians have not owned a home, and whose spouse, domestic partner, and each member of the household” has not owned a home.

I don’t get it. Why does Warnock’s plan address a racial disparity but Wyden’s doesn’t?

Are you paying attention? Didn’t I just tell you that three out of four white householders own a house? So even if they are first-time homebuyers, most white people are not first-generation homebuyers because, statistically, their parents probably owned a home. And, remember, home ownership is the greatest wealth-builder that capitalism can offer.

Meanwhile, more than 55 percent of Black potential homebuyers are both first-generation and first-time prospects.

That’s why Wyden’s DASH Act is about equality and Warnock’s plan is about equity.

What’s the difference between equity and equality?

Let’s go back to the money trees.

If we gave money trees to everyone in America, would the wealth disparity disappear?

No, the people who already have money trees would just have more money trees. But you still haven’t explained the difference between equality and equity.

Wyden’s DASH Act proposal “doesn’t see color” and treats everyone equally by giving everyone in America the seeds for a money tree. But because three out of four white people grew up in homes that already own a money tree, Wyden’s plan would give them more resources. Although his legislation distributes resources equally, it would actually increase the disparities he sought to eliminate.

Warnock’s bill would give seeds to people whose families never had a money tree. It might not erase the Black homeownership gap, but it could decrease the gap between Black and white homeownership.

And since Black people are taxpayers, Wyden’s race-neutral plan would essentially take the tax dollars from those who need it the most and hand it to the people who need it less. Warnock’s bill is supported by the National Housing Conference, National Fair Housing Alliance, Center for Responsible Lending, National Urban League and the National Housing Resource Center because it distributes resources equitably.

I thought colorblindness was a good thing.

Actually, it’s a thing white people just made up to ignore racial inequality. No one ever asked white people to “not see color.”

It is undeniable that there are racial disparities in the criminal justice system, healthcare, education, economics, politics, policing and every other segment in American society. Perhaps the reason that these problems exist is that we have fooled ourselves that colorblindness is some admirable quality to which we should aspire. If the only possible way you can treat someone as a human being is to imagine away their history, culture and ethnic identity, you’re racist as fuck. In fact, I would argue that “not seeing color” means you aren’t qualified to address a problem.

How can anyone address a problem they can’t see?

But didn’t Martin Luther King Jr. say that he has a dream that his children would be judged by the content of their character, not the color of their skin?

You’re right. He did say that.

He said it after he said the “Negro lives on a lonely island of poverty in the midst of a vast ocean of material prosperity.” It was a few minutes after he told everyone “the Negro is still languished in the corners of American society and finds himself in exile in his own land.” In that same speech, he said “America has given the Negro people a bad check, a check which has come back marked insufficient funds.”

The dream part came after he said: “There will be neither rest nor tranquility in America until the Negro is granted his citizenship rights” and that we can’t be satisfied “as long as the Negro’s basic mobility is from a smaller ghetto to a larger one.” You can’t skip over the part when he said: “We refuse to believe that there are insufficient funds in the great vaults of opportunity of this nation. And so we’ve come to cash this check, a check that will give us upon demand the riches of freedom and the security of justice.”

But most of all, he told you exactly when this dream will be fulfilled:

“This will be the day when all of God’s children will be able to sing with new meaning: My country, ‘tis of thee, sweet land of liberty, of thee I sing. Land where my fathers died, land of the pilgrims’ pride, from every mountainside, let freedom ring.”

I haven’t heard any singing.

I’m still waiting on my check.