The Federal Trade Commission and state of Florida are shutting down Grant Bae (yes, that’s the name) and its owner for allegedly giving fake grants to Black owned businesses seeking pandemic relief. Business owners were getting scammed out thousands of dollars on a promise they would be able to access millions.

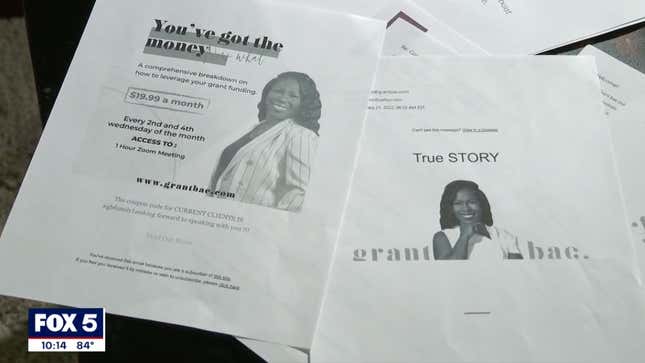

Traeshonna P. Graham, owner of Grant Bae, used social media to advertise her services of grant writing and consulting. According to the FTC’s investigation, only a few influencers and close associates actually received money from Graham’s service. However, a number of claims allege she falsely promised guaranteed funds, misled customers about grant statuses and lied about having prior success in giving out grants.

The complaints go back to October of 2020.

More from the Federal Trade Commission:

The complaint also alleges that Graham relied on funds she acquired through the federal Paycheck Protection Program COVID-19 stimulus program to start Grant Bae. A month after its founding, the company was approved for a Paycheck Protection Program (PPP) loan. Later that summer, Graham herself was approved for another PPP loan as an “independent contractor.” At times, the complaint alleges, Grant Bae said it would apply for COVID-19 Economic Injury Disaster Loans on behalf of customers.

Business owners like KB Hunt of Power Springs had to find out the hard way about Grant Bae’s scheme. Hunt, owner of a life coaching business, told Fox 5 Atlanta she reached out to Graham’s services to help fund her life coaching business. She gave $2,000 with a promise of receiving $50,000 funds.

“She was really saying that she was helping minorities to get funding,” said Hunt. “I got the email saying congratulations, you are approved for a grant so I was excited like yes. That was my first initial red flag like something in my gut just didn’t feel right.”

Her gut was right. None of the links people received worked because they were all fake, investigators found. As a result, the federal court shut down Graham’s company and froze her assets. Graham’s company is allegedly in violation of multiple laws including the COVID-19 Consumer Protection Act and Florida Deceptive Unfair Trade Practices Act by targeting minority-owned businesses with her scams.

“I’m just relieved to know that she’s been stopped. To know that she is not going to be scamming any more people and that she won’t be hurting our community anymore,” said Hunt via Fox 5.